Lumber Liquidators Lawsuit Underscores the Need for Product Liability Insurance

From time to time we get headline events that underscore the reason why we need good business insurance. These stories remind us that the risks we undertake as business owners are real and not abstract.

In a current post, we outlined how the recent litigation woes of Facebook are an example of why we need general liability insurance, and now a recent Lumber Liquidators lawsuit provides an example of how product liability issues can cause immense financial harm to your business. (More details on the story can be found at Bloomberg.com)

In a nutshell, here is what we know about the Lumber Liquidators lawsuit:

- There was concern raised about the toxicity of certain laminate flooring manufactured and sold by Lumber Liquidators, but the Center for Disease Control calculated the levels to be acceptable.

- A recent 60 Minutes report discovered that the toxin levels were much higher than original estimates.

- The 60-Minutes report caused the CDC to review its findings and amend the original report, acknowledging the health risk associated with Lumber Liquidators flooring.

- The amended findings actually conclude that the toxins are three times (3x) higher than originally reported.

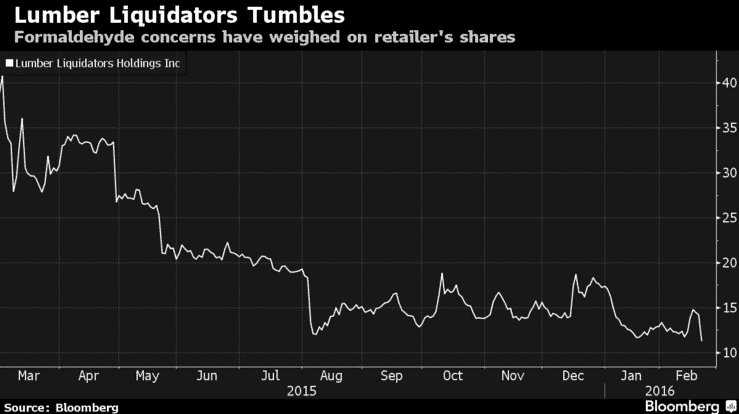

As reported by Bloomberg, this has been a financially devastating hit to Lumber Liquidators:

“The reversal brings a fresh headache to a company reeling from almost a year of crisis. Lumber Liquidators tumbled 20 percent to $11.40 at the close in New York, the biggest drop since Aug. 5. The shares already had plummeted more than 70 percent since the March airing of a “60 Minutes” story that alleged Lumber Liquidators flooring had potentially dangerous levels of formaldehyde.”

The heart of the matter and what is driving the current financial woes, is a flooring product made in China that contains dangerous levels of formaldehyde. At the levels being reported, the toxins in the flooring can cause cancer and have adverse effects on people with certain respiratory conditions.

How Would Product Liability Insurance Help?

Each case is different, and we can’t say with certainty that product liability insurance would have helped Lumber Liquidators (they likely have this form of coverage), however; what we can say with certainty is manufacturers or sellers of products should have product liability insurance protection.

At this point, it’s not clear that Lumber Liquidators will have to issue a recall of the flooring materials in question, or if anyone has yet to be harmed. However, if they do issue a recall, this becomes a prime example of a product liability insurance claim. If you’re unclear about product liability, let’s help to clarify.

Product liability occurs when a business makes a product that:

- Is defective, or

- Causes injury or harm to people

In this case, the product in question appears to have a clear defect. The laminate used contains an unsafe amount of formaldehyde.

If you are thinking about your business, and want to know how this can happen to you. Think of it in three general categories. If you have products that fall into any of these buckets, you may have a potential product liability insurance claim pending.

- Design defects. A product may be inherently flawed if the design is dangerous. Lawn darts are a classic example. Giving kids a long, sharp spike and telling them to throw it around the lawn… that’s a design defect.

- Manufacturing defects. Problems may come up during manufacturing that lead to unsafe products. For instance, a metal manufacturer could switch suppliers, accidentally use a lower-grade metal that is more likely to snap, and unwittingly make a defective product.

- Marketing defects. It’s also possible to have product liability if your product simply doesn’t work as advertised or doesn’t include adequate instructions, safety warnings, or labeling.

If you suspect that your product(s) have one of these defects, you may, right now, have a customer who has a potential product liability lawsuit against your business. To make matters worse, most states have laws that mandate some version of strict liability, which lowers the burden of proof for plaintiffs, making it easier for them to hold you liable for product injuries.

What are the Mechanics of General Liability Insurance / Product Liability Insurance?

In cases of product defects, product liability insurance can certainly provide protection to a business from the cost of a product injury or defect-related lawsuit in the event of a covered loss. This form of coverage is typically included in your General Liability Insurance policy. You may find it on your policy declarations called “products-completed operations insurance.”

Conclusion

To further underscore the importance of product liability insurance, you should review your state’s laws relating to product liability. In some cases, anyone in the supply chain may be held liable for defective products.

The laminate was manufactured by Lumber Liquidators – but liability may ultimately be determined to reside with Lumber Liquidators. That’s just how product liability works. If you run a business, you may be held responsible for your supplier’s mistakes. Just another reason to have good business insurance.

With Product Liability Insurance in place, manufacturers of all stripes can protect their businesses. As Lumber Liquidators’ case shows us, sometimes an unexpected problem from further up the supply chain can cause your business to face potential lawsuits, like the Lumber Liquidators lawsuit.

Image Source: Jolene Hardy

Compare Business Quotes

Looking for business insurance? Click “Start a Quote” to compare Business Owner’s Policy and Worker’s Compensation rates. Ready to purchase? Choose “Quote & Buy Online” to buy directly online.

Rather speak with an insurance agent?

1-877-334-7646