When Do I Need to Buy Workers’ Compensation Insurance?

If you’re an employer, it’s important to have workers’ compensation insurance to protect both you and your employees. Workers’ comp is a business insurance coverage that takes care of your employees in the event of an injury or illness on the job, regardless of fault. It also saves employers from potentially expensive lawsuits from employees who get hurt on the job. But when is the right time to buy workers’ compensation insurance?

Before we answer that, let’s cover some of the basics. In most states, you’re required to have workers’ comp coverage if you have employees, even if you’re a small business owner or just starting out. Because of this, it’s commonly considered important to have coverage in place as soon as you hire your first employee. If you don’t have it, you’ll have to pay for any work-related medical bills out of your own pocket.

So, let’s cut to the chase, you need to buy workers’ compensation insurance as soon as you hire your first employee. This will help you avoid potential legal trouble, expensive medical bills, and fines.

We can do better than that, let’s dig in a bit deeper.

Know your state’s workers’ compensation regulations

When considering your first workers’ compensation policy, it’s important to be aware of the workers’ compensation laws for each state you operate. For instance, if your company is based in one location but employs staff elsewhere – such as remote employees or those from other states- then you’ll need different coverage depending on the laws of each state.

Furthermore, the number and type of people employed can also affect when(and how)you get insurance; some states have rules that require companies with any employee at all (including corporate officers/relatives!) to obtain workers’ comp policies – whereas others may stipulate two, three or five persons before compulsory coverage kicks in.

Other common questions regarding workers’ comp requirements include:

Do I need to buy workers’ compensation insurance for part-time employees?

The same rules apply to part-time employees as those employed in a full-time capacity. Therefore, if you have to provide it for full-time employees then you’ll need it for part-timers as well.

Do you need workers’ comp for remote employees?

Even if your team is working from home, it’s important to make sure they’re covered in case of injury or illness related to their job. Remote employees are considered the same as on-location employees. While it may seem like a low-risk situation, accidents can happen anywhere, and having the right insurance can protect both you and your employees. Learn more about workers’ compensation for remote employees.

Do you need to buy workers’ comp for contractors?

If you’re hiring contractors to do work for you, you might be wondering if you need to buy workers’ compensation for them. The short answer is that it depends on where you are and what type of work the contractor is doing. In some states, businesses are required to have workers’ comp insurance for contractors, while in others, it’s not necessary. This gets us back to one of our earlier points, make sure you know your state’s regulations.

Should you buy workers’ comp insurance even if it’s not required?

If a small business is anything, it’s extremely aware of its budget and expenses. It’s reasonable to ask if you should buy workers’ compensation if it’s not required. In fact, even if it’s not mandated by regulation, there are still very good reasons to buy workers’ comp. Here are a few reasons you should consider workers’ compensation insurance even if it’s not mandatory:

- Protecting your business: Accidents do happen on the job. If an employee is injured while working for you and you don’t have insurance, you could be held liable for their medical expenses, lost wages, and even legal fees. Workers’ comp insurance can protect your business from these types of financial risks.

- Attracting and retaining employees: Providing workers’ compensation insurance can be an attractive benefit for employees. They’ll know that if they’re injured on the job, they’ll be covered, providing peace of mind that helps with employee retention and morale.

- Improving workplace safety: When you have workers’ compensation insurance, your insurance provider may offer safety resources and training to help mitigate workplace accidents. By implementing safety measures, you can reduce workplace injuries.

- Legal and contractual compliance: Having workers’ compensation insurance can help you stay compliant with other laws and contractual requirements. For example, some contract work will require businesses to have workers’ comp insurance, so having it could help you get more clients or jobs.

Most workers’ comp policies include employer’s liability insurance. This coverage helps protect your business if an employee claims your negligence was the cause of their injury or illness. Consider this, once a workers’ comp claim is settled, the employee can no longer bring additional claims or litigation related to that specific injury or illness.

What if you don’t buy workers’ compensation insurance?

If workers’ compensation is required by your state’s regulations, the decision to not buy the coverage can have financial and even criminal consequences. It is highly recommended you comply, and buy workers’ compensation insurance.

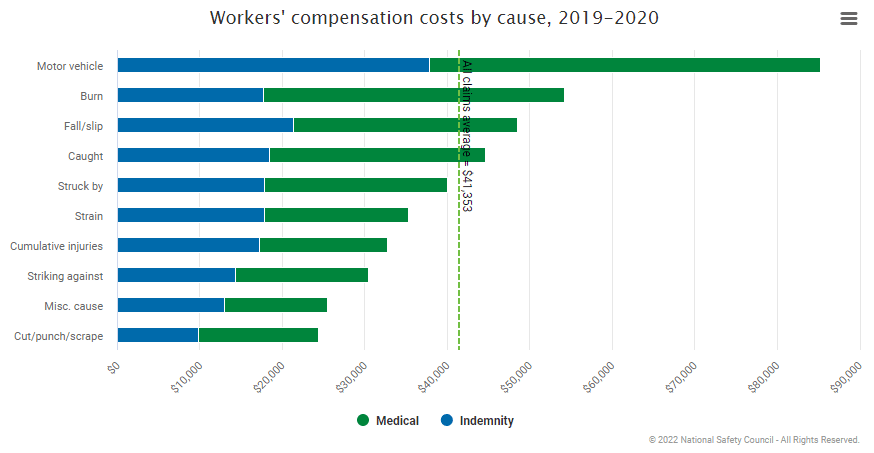

However, where workers’ comp is not required, you may consider avoiding the expense of workers’ comp. Before you do this, you need to fully understand the financial risk you’re underwriting. According to the National Safety Council, the average workers’ comp claims settlement was $41,358 for data collected from 2019 to 2020.

How much does workers’ comp insurance cost?

The cost of workers’ compensation insurance can vary widely depending on the size of your business, the industry you’re in, and other factors. According to the National Academy of Social Insurance, the average cost of workers’ compensation insurance in 2019 was $1.29 per $100 of payroll. However, this can be higher or lower depending on your specific situation.

Insurance companies use a variety of factors to determine your workers’ compensation premium. These can include the size of your business, the industry you’re in, your claims history, and the types of jobs your employees perform. For example, a construction company may have higher premiums than a retail store because the risk of injury is higher in the construction industry.

There are a few things you can do to help reduce your workers’ compensation premiums. One is to implement safety measures and training programs to reduce the likelihood of workplace injuries. Another is to work with an insurance agent to shop around for the best rates and coverage options. Finally, using a pay-as-you-go plan, which can help you manage cash flow and avoid large up-front premiums.

The bottom line

Workers’ compensation is mandatory in nearly all states, so you’re going to have to buy workers’ compensation insurance. When is the right time to buy is the question. The best time is just prior to bringing on your first employee. This will help keep you compliant, as well as begin providing important coverage for you and your employees in the event of workplace injuries or illness.

The cost may be a concern and some of the drivers of premium will be outside your control. However, if you work with a good business insurance agent, you can shop the market and find the best value and protection. If you don’t have an agent, contact us, or you can start your quote online.

Compare Business Quotes

Looking for business insurance? Click “Start a Quote” to compare Business Owner’s Policy and Worker’s Compensation rates. Ready to purchase? Choose “Quote & Buy Online” to buy directly online.

Rather speak with an insurance agent?

1-877-334-7646