How Much Does Boat Insurance Cost? A Complete Guide for Boaters

You bought a boat for the ultimate freedom. Those perfect moments when it’s just you, the open water, and endless possibility. Then reality check — “how much does boat insurance cost?”

Suddenly, it’s not all wind in your hair and the horizon stretching out before you.

It’s not all that bad.

Freedom isn’t just a concept — it’s still that feeling you can taste, smell, and experience. But it does come with an additional a price tag beyond the initial purchase.

Boat insurance isn’t another boring expense. It’s your financial life jacket in a world of unpredictable waves. It’s the difference between a minor setback and a complete financial disaster.

Do You Really Need Boat Insurance?

Let’s cut through the noise. You might be thinking, “It’s not legally required everywhere. Do I really need boat insurance?”

Here’s the unvarnished truth: Absolutely. Without a doubt. No questions asked.

Your homeowner’s insurance policy is about as useful for comprehensive boat protection as a screen door on a submarine. Most policies provide minimal coverage, typically capping at $1,000-$1,500 for boat-related incidents — a drop in the ocean compared to potential real-world costs.

The risks are stark and unforgiving:

- Liability for injuries that could run into hundreds of thousands of dollars

- Physical damage from accidents, storms, or unexpected incidents

- Theft of your valuable vessel

- Weather-related losses that can total your boat

- Potential legal battles that could drain your bank account

Marinas won’t let you dock without proof of insurance. Lenders require comprehensive coverage before you can even finance a boat. It’s not a suggestion. In most cases, it’s a necessity.

Average Boat Insurance Cost: Breaking Down the Numbers

Boat insurance isn’t going to be the same for everyone. It’s a complex calculation that takes into account more variables than you might imagine.

National averages provide a starting point, but your specific situation will determine the final cost:

- Personal watercraft: $100–$300 per year

- Runabouts and pontoons: $250–$600 per year

- Cruisers and cabin boats: $500–$1,500 per year

- Yachts or high-performance boats: $1,500–$5,000+ per year

Let’s break down what drives these numbers. Your location matters. The type of water you’ll navigate matters. How you’ll use your boat matters. These aren’t just arbitrary figures — they’re carefully calculated risk assessments.

Boat Insurance Costs by Region:

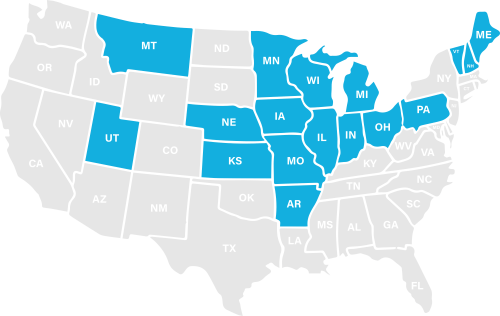

Lower Cost Region – States

Annual policy average: $250

States included: Arkansas, Illinois, Indiana, Iowa, Kansas, Ohio, Maine, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, Pennsylvania, Utah, Vermont, and Wisconsin.

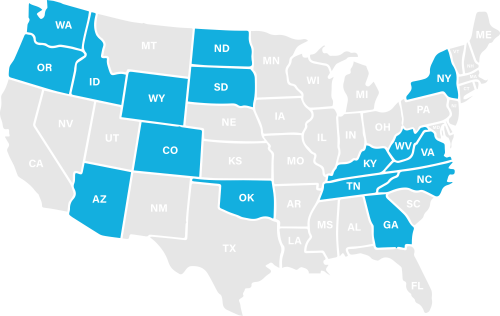

Medium Cost Region – States

Annual policy average: $329

States included: Arizona, Colorado, Delaware, Georgia, Idaho, Kentucky, New York, North Carolina, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Virginia, Washington, West Virginia, and Wyoming.

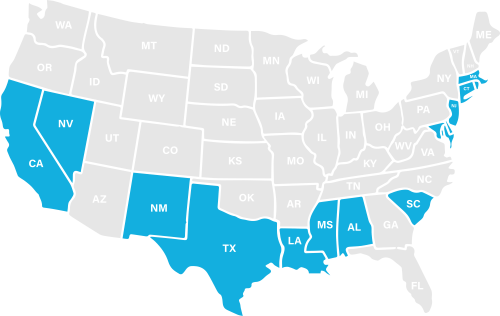

Higher Cost Region – States

Annual policy average: $471

States included: Alabama, Alaska, California, Connecticut, Florida, Hawaii, Louisiana, Maryland, Massachusetts, Mississippi, Nevada, New Jersey, New Mexico, South Carolina, Rhode Island, and Texas.

What Drives Your Boat Insurance Costs?

Boat insurance isn’t magic or two guys in a back room combing up with premiums. It’s math. And you’re part of the equation.

The drivers of your premium are something like this:

1. Type, Size, and Value of the Boat

Not all boats are created equal. A sleek powerboat speaks a different risk language than a modest pontoon. Each vessel tells a unique story to insurers.

Consider the differences:

- A high-performance offshore racing boat comes with entirely different risk profiles compared to a small fishing boat

- Wooden boats require different coverage considerations than fiberglass vessels

- The replacement cost directly impacts your premium

High-performance boats with roaring engines? Expect higher premiums. Larger boats mean more potential damage. More expensive vessels mean steeper replacement costs. It’s risk mathematics in its purest form.

2. Age and Condition of the Boat

Older doesn’t always mean cheaper. An aging boat can be a complex insurance risk. That vintage vessel might have classic charm, but insurers see potential maintenance nightmares.

A 20-year-old boat meticulously maintained might be a better insurance risk than a three-year-old vessel that’s been neglected. Insurers look beyond the manufacturer date. They’re interested in condition, maintenance history, and overall vessel integrity.

3. Engine Type and Horsepower

Power isn’t just about speed. It’s about risk.

Insurers pay close attention to your boat’s engine. A 300-horsepower monster isn’t the same as a modest 50-horsepower motor. Each additional horsepower tells a story of potential risk.

High-performance engines mean:

- Increased likelihood of speed-related accidents

- Higher potential for catastrophic damage

- More complex repair and replacement costs

- Greater statistical probability of insurance claims

The math is simple for insurers. More power equals more risk. Your dream of cutting through waves comes with a premium price tag.

4. How and Where You Use the Boat

Not all water is created equal. The difference between a calm lake and rough coastal waters is more than just scenery — it’s a significant insurance calculation.

Consider these risk factors:

- Coastal waters present more complex navigation challenges

- Offshore boating requires additional insurance considerations

- Frequency of use impacts your risk profile

- Geographic location determines weather-related risks

A boat primarily used on inland lakes will have a different insurance approach compared to a vessel navigating ocean waters. Your sailing range becomes a critical part of your insurance equation.

5. Storage and Mooring Location

Your boat’s home matters as much as its adventures. Storage isn’t just about keeping your vessel safe — it’s a key factor in insurance pricing.

Storage options impact your premium:

- Secure marina storage typically offers lower risk

- Outdoor trailer storage increases potential for damage

- Climate-controlled indoor storage can reduce insurance costs

- Security features and location play a crucial role

A boat stored in a protected, monitored marina presents less risk than one left exposed to the elements. Insurers do the math, and you pay the price.

6. Your Boating Experience

Experience is the currency of insurance pricing. Think of it like a professional certification for boaters.

Insurers look for:

- Completed safety courses

- Years of boating experience

- Clean boating and driving records

- Proven responsible behavior on the water

An experienced captain with a spotless record pays less. It’s that simple. Your years of navigating waters become a financial advantage.

7. Coverage and Deductibles

Boat insurance is a balancing act between protection and cost. More coverage means higher premiums. Lower deductibles mean less out-of-pocket expense.

Key considerations:

- Comprehensive coverage provides maximum protection

- Higher deductibles can lower your monthly premium

- Specialized coverage options exist for unique boats

- Your personal risk tolerance matters

It’s about finding your financial sweet spot. Protection versus cost. Peace of mind versus monthly expense.

8. Regional Risk Factors

Your location is more than a dot on a map. It’s a complex risk calculation that insurers meticulously evaluate.

Regional factors include:

- Weather patterns and natural disaster risks

- Local theft and crime rates

- Frequency of boating-related incidents

- Environmental challenges specific to your area

A boat in hurricane-prone Florida faces different insurance challenges than one in a calm Minnesota lake. Your zip code tells a risk story insurers are eager to read.

Common Boat Insurance Coverages

Boat insurance coverage isn’t one-size-fits-all. Your policy is a custom-tailored protection plan.

Essential coverages include:

- Hull and Machinery Coverage: Your boat’s physical shield against damage

- Liability Coverage: Protects you from potential legal and financial nightmares

- Medical Payments: Covers injuries to you and your passengers

- Uninsured Boater Protection: Your safety net when others fall short

- Personal Effects Coverage: Protects your onboard gear and equipment

- Fuel Spill Liability: Because accidents happen, and cleanup is expensive

- Emergency Towing and Assistance: Your lifeline when things go wrong

Each coverage is a layer of protection. Each layer comes with a cost. But the alternative? That’s the real expense.

How to Lower Your Boat Insurance Costs

You’re not powerless. Smart boaters can strategically reduce their insurance expenses.

Proven cost-cutting strategies:

- Complete accredited boat safety courses

- Bundle multiple insurance policies

- Maintain an impeccable driving and boating record

- Choose a higher deductible to lower monthly premiums

- Consider seasonal lay-up periods

- Install advanced safety features and tracking devices

- Pay your annual premium upfront

- Invest in professional boat maintenance

- Take advanced navigation courses

Pro tip: Insurers reward proactive, responsible boat owners.

Getting the Best Value, Not Just the Cheapest Policy

Cheap boat insurance is an illusion. Comprehensive protection is the reality.

Consider the potential costs of a major incident:

- Boat replacement can run into tens of thousands of dollars

- Medical expenses from a single accident could devastate your finances

- Legal complications can drain your savings

- A comprehensive policy is an investment, not an expense

Independent agencies like IronPoint can help you:

- Compare multiple carriers

- Understand complex policy details

- Tailor coverage to your specific needs

- Find the best value, not just the lowest price

Conclusion: Charting Your Course to Comprehensive Protection

Every boat tells a story. Yours is about more than just a vessel on the water. It’s about adventure. Freedom. The promise of endless horizons and unforgettable moments.

But those moments are fragile. One unexpected incident can turn your dream into a financial nightmare. That’s where IronPoint Insurance Services steps in.

We’re not just selling policies. We’re protecting your passion. Our team understands that your boat is more than an asset — it’s a lifestyle. We’ve spent years navigating the complex waters of marine insurance, helping boat owners like you turn potential risks into peace of mind.

Our approach is simple:

- Customized coverage that fits your unique needs

- Competitive rates from top carriers

- Expertise that goes beyond the standard policy

- Personal attention that treats your boat like our own

The cheapest insurance isn’t the best insurance. The best insurance is the one that gives you the confidence to explore, to adventure, to live fully on the water.

Don’t let uncertainty anchor you to the dock. Your next great adventure is waiting.

Looking to buy boat insurance, give us a call. Not a fan of the phone, start the conversation online.

Get a Boat Insurance Quote

Let us compare boat insurance quotes for you. We make it fast, safe, and secure.

- Let’s Get Started!

-

Have an Agent Call

- Compare Business Quotes

-

Business Owners’ Policy

-

Workers’ Compensation

-

General Liability

-

Commercial Auto

-

Cyber Liability

- Personal Insurance

-

Auto

-

Home / Condo / Renters

-

Motorcycle

-

Classic Car

-

Boat / Yacht

- Quote & Buy Online

-

Small Business Insurance

-

Mexico Auto Insurance

-

Pet Insurance

Call 1-877-334-7646 to speak with an insurance specialist.

Key Takeaways:

- Boat insurance isn’t required everywhere, but it’s vital protection against accidents, theft, and costly damage.

- Average cost runs $250–$1,500 per year, depending on your boat, location, and experience.

- Save money and stay covered by bundling policies, completing safety courses, and maintaining your vessel.