Explore the Real Cost of Home Insurance Claims

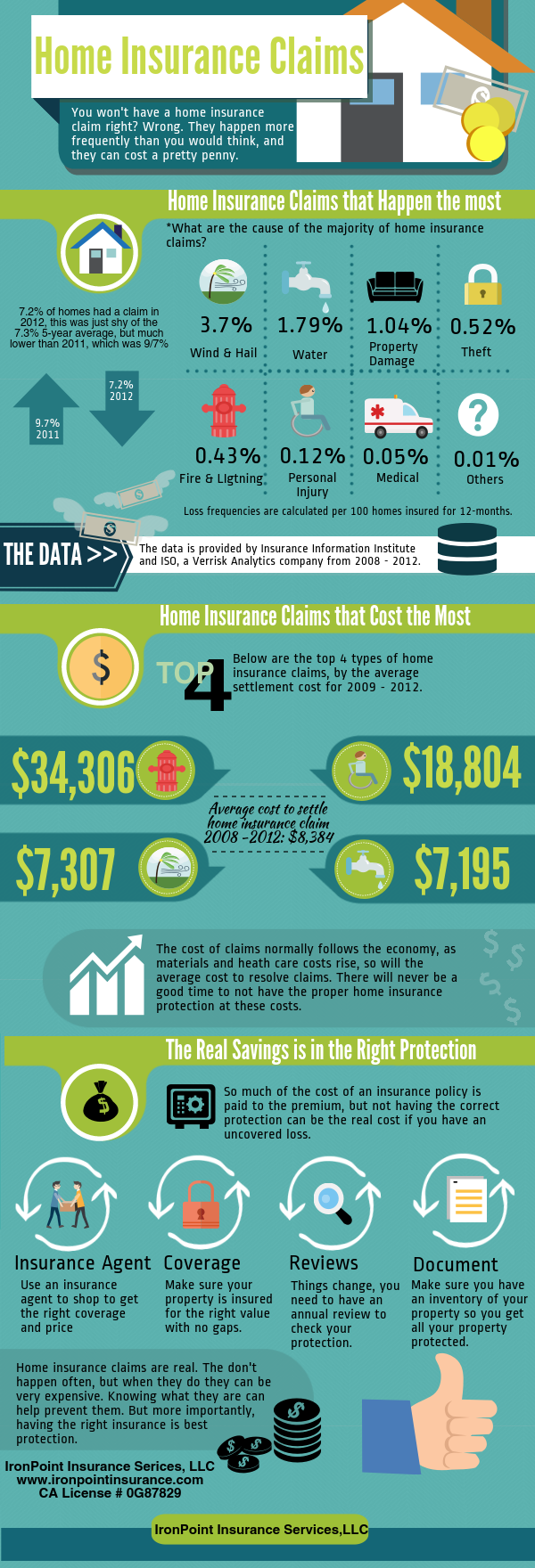

Nobody plans to have a home insurance claim, but they happen. According to ISO, 7.2% of homes had to make a home insurance claim in 2017. With the number of claims rising, it’s a good idea to look at the numbers. Because these claims are expensive and gaps in coverage can be costly. So, what is the real cost of home insurance claims?

Some of you may be thinking, it’s only 7.2% of homeowners. That’s a reasonable number. However, when you realize that home insurance, unlike auto insurance, is not measured in the frequency of loss (number of occurrences per 1,000 exposures), but the severity (average cost), you’re brought back to reality. The cost of home insurance claims, not the number or percent, is the real culprit.

In 2017, the average home insurance claims “severity” cost was $8,665, with the most expensive claims coming from fire and lightning, where the average claims cost can be $34,307 (averaged between 2008 – 2012).

So, when we start to think about the home insurance claims costs, then we start to better understand what is really at risk.

Home insurance claims by peril

The home insurance industry categorizes home insurance claims into perils, below are the two perils that cause loss over the years from 2008 – 2012.

- Fire & lightning

- Bodily Injury

- Wind & Hail

- Water

- Property Damage

- Theft

- Medical Payments

- Credit Card and Other

To help you better understand the major sources of home insurance claims costs, we have put together this infographic.

According to the Insurance Information Institute, less than 50% of homeowners indicated that they had created a home insurance inventory in the last 8 years.

A home insurance inventory is an extremely important resource when presenting a home insurance claim, it will help to illustrate the exact property that you had prior to your home insurance loss, giving the insurance adjuster the best opportunity to replace your property.

A home insurance inventory is easy to create, you can use a digital camera or video recorder and simply walk through your home and document your possessions. Once completed, create a copy and store it in a fire-resistance safety box. It is also a good idea to create a second version and store it in a location other than your home. This will create redundancy in your documentation and provide a backup if necessary.