Coffee and Auto Insurance, Which Costs less?

As a self-proclaimed coffee enthusiast, and insurance nerd, I couldn’t help but notice there is a relationship between coffee and auto insurance. That’s right, coffee and auto insurance, it’s not just for breakfast anymore.

I joke, but the next time you stop to see your favorite barista, know that your morning coffee cost more than your auto insurance. In fact, it cost more than many insurance products, like life insurance or a boat policy.

I doubt this revelation is going to make you put down your favorite cup of coffee. But it does lead me to another comparison between coffee and auto insurance. The thought of them being a commodity.

The brilliance of Starbucks

Before Starbucks, coffee was … well … just coffee. Starbucks changed our impression of coffee from a simple commodity to something else entirely. The brilliance of Starbucks was that it changed coffee from a drink, and created “an experience” that compelled consumers to pay $2 – $6 for a cup.

That’s right, that simple cup of coffee that your local diner used to sell you for $1.00 (or less), is now a premium product that consumers pay “value” prices to get it.

What does this have to do with auto insurance?

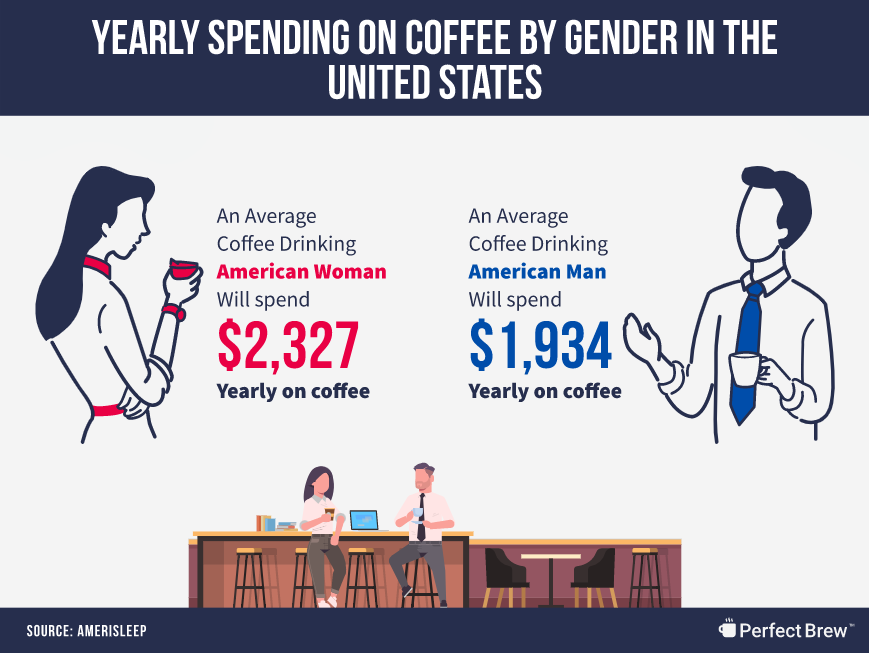

Ok, let’s get to the point. That same morning experience … err … coffee, cost more than the average auto insurance policy. That’s right, according to Perfect Brew, men will spend $1,934 per year on coffee, and women spend a staggering $2,327. That is much more than the $1,700 average cost of auto insurance.

Sure, we all enjoy the morning pick-me-up. If you’re like me, you may not even be able to function correctly without your morning cup. But this underscores my point. Coffee is a commodity. In fact, it trades on the global commodity markets. Granted it’s one of the most widely traded commodities, but a commodity non the less.

A good cup of coffee costs less than 20 cents to brew at home, yet people comfortably pay $3 – $6 per cup at their favorite shop. Then complain about the cost of auto insurance.

Coffee rules! I hate to pay for auto insurance

We get it, it’s hard to compete with coffee. Comparing coffee and auto insurance is strictly tongue-in-cheek. Coffee is an important part of our morning routine, it’s a tangible product, and has a stimulant. Auto insurance was never going to come out on top.

Intellectually, it raises some questions for insurance marketers. What lessons can be taken away from the Starbucks story? By converting a commodity to an experience, they radically changed the coffee market. Auto insurance has real value, someone has to be able to spin that into something better than a lizard with a catchline.

Auto Insurance is not a commodity

The reality is that auto insurance is not a commodity, and there are real differences between insurance companies and insurance agents. When you use your auto insurance, you get something much more important that the benefits derived from a morning coffee.

It is true that your auto insurance is an intangible product. You can’t wear it, eat it, or drive it, but you will need to use it at some point in your life.

If you’re not willing to invest as much in your auto insurance as you do in your morning coffee, you may find out the hard way what a ‘bad’ auto insurance company looks like. You won’t be able to pour that out in the bushes and get a fresh cup if you don’t like it either.

Products become commodities when marketers run out of ideas, and everything is reduced to price. For the auto insurance market this hit its high when GEICO created the “15 minutes can save you 15% on your auto insurance” campaign. Before this advertisement, insurance advertising generally focused on the value of solid insurance protection. That was the period of the “Good Hands People,” “Get a Piece of the Rock,” or “Get Met it Pays” advertising.

Since GEICO created these campaigns, all we hear now from insurance advertisers is save, save, save. It’s really tiring.

The bottom line

Roughly 20% of Americans consider switching auto insurance each year. If this is you, think about the money you spend on less valuable things, like coffee, to put your auto insurance premium in perspective. Then call your local independent insurance agent and get a caramel macchiato auto insurance policy with some home insurance sprinkled on top.

Compare Quotes Online

Want to know if you can save on home or auto insurance? See for yourself. Start a quote today.

Give us a Ring

1-877-334-7646

Call today and speak with a professional insurance agent.